Remember back in the day when you had to stand in long banking queues just to transfer money? If you don’t, you’re lucky not to be traumatized by the sound of a computer-generated voice calling out “No.68 next in line.”

Technology has evolved to such an extent that Gen Z doesn’t even know what the inside of a bank looks like. Everything takes place online and doing mundane tasks have now become streamlined with digital offerings that make everything faster and more seamless.

Thanks to digital innovations such as money transfer apps, or peer-to-peer (P2P) money transfer apps, cash can be seamlessly and securely transferred from person to person, or business to business.

You can even link the app to your credit card and bank account. And the best thing is, electronic transactions and payments are done with a simple few taps.

Money Transfer App Development — Reliable Idea?

So, you’ve probably figured by now what this article is about. Yes, you guessed right, it’s all about money transfer app development and why it’s essential in a cash-free environment.

In essence, P2P is so much more than a money transfer app - it allows users to make instant payments without having to use a bank or credit card, and enables transactions via cashless payment methods. Did we also mention you can exchange currency?

Let’s use the insurance broker analogy.

When taking out new insurance, the first thing you do is call your broker. They, in turn, act as the go-between you and the insurance company. As the middleman, they act in your best interest while getting paid to do a job. But sometimes, things get lost in translation which can lead to some costly mistakes.

Imagine not dealing with a middle man and going directly to the person supplying you with a product or service. It means no extra expenses and zero chances of things going wrong.

That’s exactly what a money transfer app does.

If money piques your interest, how about the fact that the global P2P payment market was valued at $1.89 trillion in 2021? And, according to the Precedent Research report, it’s growing exponentially and expected to reach about $9.87 trillion by 2030.

How do you like them apples? It’s a lucrative niche practically begging to be tapped into.

We’ll not only explain the importance of payments apps, but provide you with a step-by-step guide on how to implement your own money transfer software.

What is a Money Transfer App?

As explained previously, money transfer apps are essentially instant banking without the middleman.

If you really want to go into detail, the majority of P2P apps consist of a digital wallet, This enables consumers to deposit funds that can be used for payments or international transfers.

Money transfer software comes in all shapes and sizes. However, the end result is exactly the same - convenience, flexibility, security and transparent fees.

There are a variety of features, including digital wallets, bill payments, expense trackers and expense tracking. We’ll discuss this in more detail further down.

Another thing to take into consideration is to note the difference between P2P apps and traditional banking systems.

Dedicated money transfer apps work independently from banks, meaning they avoid the complications and high costs that arise from transferring money between bank accounts in different countries.

Types of Money Transfer Apps

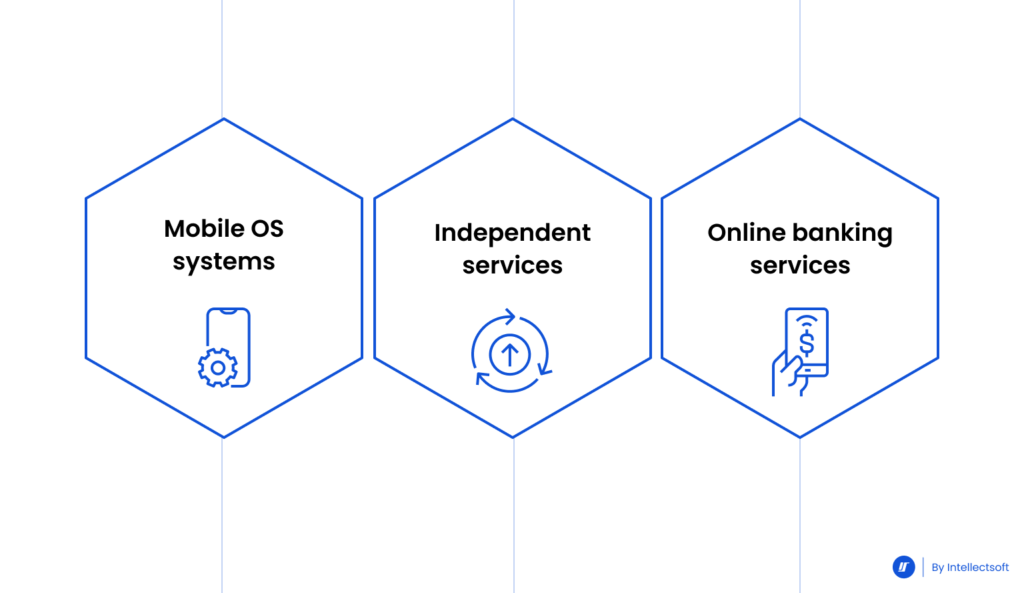

Mobile OS systems

You might not be aware of it, but widely used P2P services such as Apple Pay and Android Pay are examples of mobile OS systems.

Because of contactless payments for purchases wherever NFC technology is supported, the app software has grown in popularity.

However, there is one drawback - users of Android or Apple devices can only make money transfers to users of the same system.

Independent services

PayPal leads the pack when it comes to independent services. Basically, the app allows for card payments with the help of electronic wallets whereby P2P payments are made.

The downside? All independent services as a minimum support Visa and MasterCard card types.

Online banking services

The traditional way of banking will soon become obsolete and no one knows this better than the baking sector.

As a way of jostling for space in the digital sphere, banks are competing with each other by keeping abreast of trends. And because of this, many are offering their clients P2P services.

Good examples of these bank-centric apps are Zelle and Dwolla.

Must-have Features of a Money Transfer Application

For a safe, secure and reliable money transfer app, you need to have the following features for critical functionality.

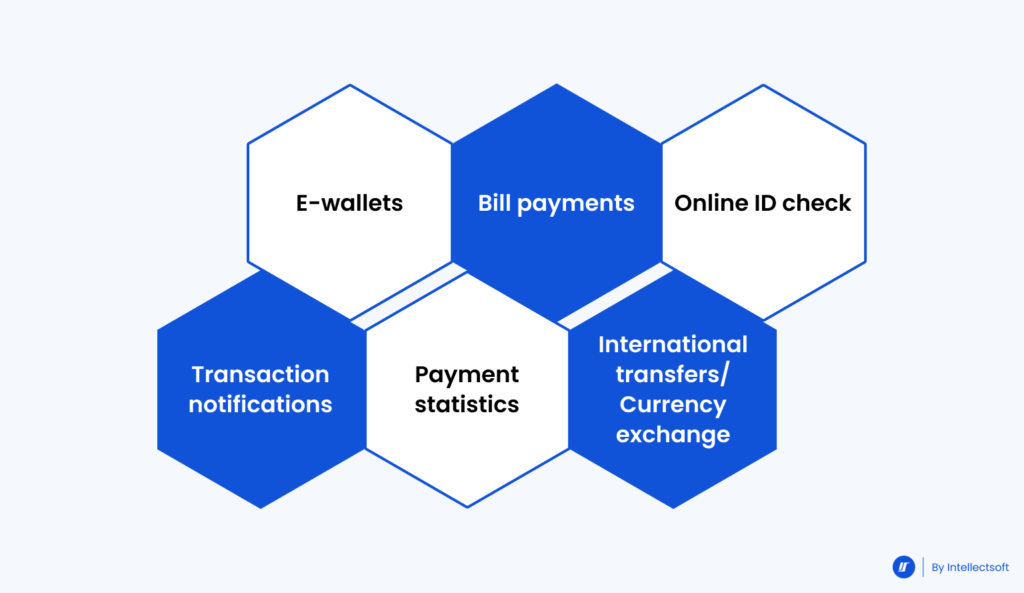

E-wallets

E-wallets give you the freedom to store electronic money and make contactless payments. Because the app stores your bank card data, there’s no need to create a new bank account. An example is PayPal’s mobile wallet app.

Bill payments

Used by some businesses as their competitive edge, users are able to make online payments at any time, from anywhere in the world.

“Bill-paying services are important tools to help consumers pay their bills and provide insight in how they are living their lives and allow consumers to take a more active role in their saving and spending strategy,” Michael Hershfield, founder and CEO of Accrue Savings, told US News.

Money managing apps such as Mint and Prism make it easy to pay and track your bills, using a smartphone or any mobile device.

Payment statistics

Data is king and that is why this feature is so important. Users can manage their finances effectively by visualizing all user transactions according to volume, status, country, and receiver.

The result is a seamless experience, enabling users to interact with their financial statistics.

Online ID check

Users want to know that their data and sensitive information is safe from enterprising cybercriminals. This feature protects against online fraud.

Transaction notifications

Every time activity occurs on an account, the user is notified via pop-ups or push notifications. This feature is very important as it drives customer loyalty.

International transfers/Currency exchange

Users want to know that the hassle has been taken out of international money transfers. By making it easier for them, you’ve already gained an ardent customer.

If they can conduct or receive international money transfers in a few seconds without the delays and high fees, even better.

The same goes for currency exchange. An integrated currency exchange feature adds value to your product. Imagine being able to receive dollars, euros, or other currencies without physically walking into a currency exchange institution? You can make that a reality.

According to Investopedia, the best international transfer and currency exchange apps currently on the market are PayPal, WorldRemit and Cash App.

How to Develop a Money Transfer App? Steps to Create

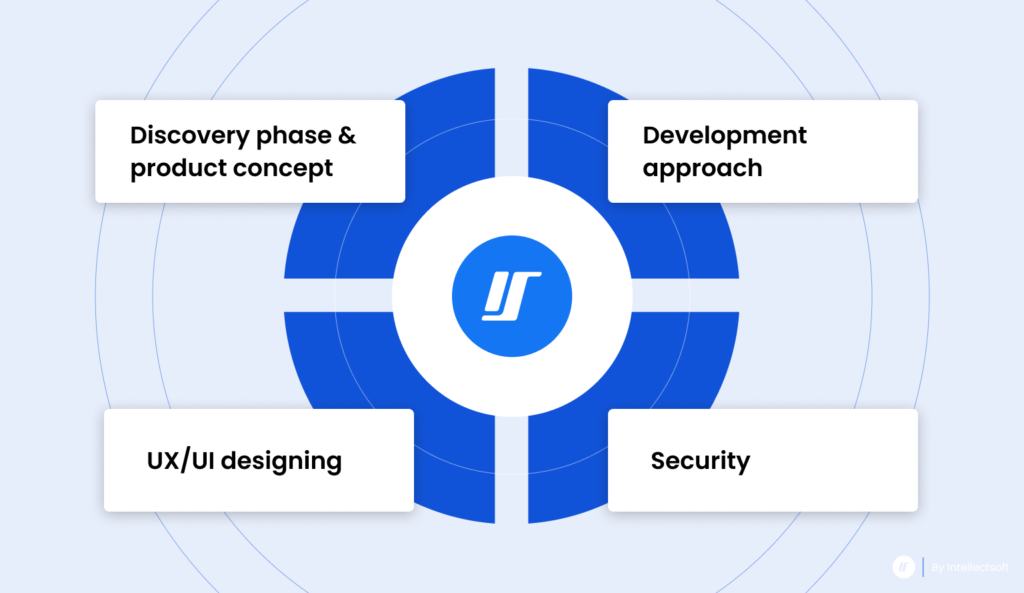

Discovery phase, product concept and main features

Before you get into the building of your app, the discovery phase can be viewed as the preliminary stage of your project and probably the most important. It will lay the foundation and ultimately make the difference between the project being a success or failure. You’ll be able to identify which stakeholders in the business need to be involved, who your target audience is, pain points your solution will solve, the scope of the project as well as design features. All these steps will help define a succinct product strategy.

The stakes are high - 99.5% of consumer apps fail and doing your due diligence at the beginning before you start to build your app, could make all the difference.

UX/UI designing

While your engineers and developers will be taking care of everything in the back-end to make sure your app does its job, user experience and user interface design plays a critical role in the front-end.

An intuitive interface and user-friendly design can set your app apart from the competition but more importantly, will keep users coming back. A bad user-experience could mean the user is lost forever. Developing a well researched customer journey map will provide insight into how a user will interact with your app and show clear steps on how they’ll reach their goal, and in this case, transfer money.

Great design should solve the needs of the user and get them to their desired goal effortlessly. Satisfied customers drive higher conversions.

Development approach

Businesses can approach this in two ways: in-house development and software development outsourcing.

If you choose the latter, Intellectsoft could be your reliable choice. Using fintech app solutions to simplify and increase the effectiveness of financial operations, Intellectsoft’s years of experience ensures your business will perform, thanks to future-proofed technologies.

Security

Pull quote:

CyberNews security researchers found that 14 top Android apps, downloaded by more than 140 million people in total, are leaking user data due to Firebase misconfigurations. Exposed data potentially includes users’ names, emails, usernames, and more.

When data breaches occur, your app and company could suffer significant financial and reputational damage. As cyber criminal activity increases, your users are at risk of paying the highest price and when it comes to sending money, your app will need to provide the highest level of security.

App security best practices

- User authentication

- Authorization

- Encryption

- Secure APIs

How much Does It Cost to Build a Custom Money Transfer App?

There are various factors to take into consideration when it comes to the costs. It can take anything from $11 000 to $15 00, depending on the features.

For example, an app with the minimum amount of features (minimum viable product), is less than an app with more functionality.

Below, we take a look at the technologies needed:

API integration

“An application programming interface (API) is a way for two or more computer programs to communicate with each other,” according to Wikipedia.

Still finding it hard to understand? Think of it this way; APIs act as a sort of translator between two systems so that they find it easier to communicate and understand each other.

Why is it important for a money transfer app?

It’s essential to link your app to other applications to ensure a seamless user experience.

Chatbots

In many instances, chatbots have been compared to the rise of the machines but they can bring in an element of conversation AI support. No need to worry about them taking over the world. If you understand how a chatbot works, you’ll know when it’s important to integrate it into your app.

Basically, a chatbot is a software app that is used to conduct an online chat conversation via text or text-to-speech, in the absence of having direct contact with a live human.

Combined with AI capabilities, this technology provides customers with around-the-clock support.

Notifications

As discussed in our Must-have Features sections, notifications alert users whenever a transaction or activity on an account has occurred. These notifications can include when money is deposited into an account, confirmation of money being sent and when the funds have landed with the recipient.

Security

Enterprising criminals always target vulnerable systems. Sensitive data in the wrong hands can lead to all sorts of activity. As a defense for your customer, two-factor authentication is crucial when building a money transfer app. This type of authentication requires the user to provide two ways to verify their identity with the aim of strengthening overall security and access.

What Makes Your Money Transfer App Secure?

There’s no question about it; when it comes to security, you need to make sure there’s no room for being attacked from the outside.

“Because the money is immediate, you want to make sure your payments are to people you know and trust,” explained Bobbi Weber, Fraud Operations Group Manager and Senior Vice President of Fraud and Claims at Citizens Bank.

To prevent mistakes and fraud, take the following into consideration:

Payment Gateway Protection

A study by PWC, Global Economic Crime and Fraud Survey 2020, found that 47% of companies experienced some form of fraud, resulting in $42-billion of losses.

What payment gateway protection does is encrypt sensitive transaction data. The encryption translates the data into another form so that only people who have access to a secret key can decrypt it.

Testing

Make sure during the software development phase that your app is able to withstand various checks. This is called the testing stage.

Also known as “penetration testing,” these measures are aimed at detecting vulnerabilities in the app.

A cyber Safe environment

Don’t be fooled into thinking your app is not vulnerable to cyber attacks. The best approach to take is a defensive one.

Key measures include a robust IT infrastructure, building secure application logic, ensuring web-server security and writing secure code.

Consider Intellectsoft Your Trusted Partner

With an impressive client portfolio and more than a decade of experience behind its name, Intellectsoft prides itself on cutting-edge solutions to get the job done.

Our skilled experts provide custom financial software development to fit your business and budget requirements, without compromising on leading-edge technologies.

One of our success stories was to develop a global mobile banking platform for a client that enabled people to open bank accounts and access P2P banking services.

Intellectsoft incorporated blockchain, biometrics technology and three-factor authentication to ensure user data was safe and secure when sending money across the globe.

Conclusion

It’s a given that the world is moving towards a cashless society. Fintech solutions are the future. The question is, are you and your company moving in the same direction?

FAQ

What is a money transfer app?

Money transfer apps let you transfer cash from person to person, or from entity to entity, quickly, conveniently, cheaply, and securely.

What are P2P payments?

Peer to Peer (P2P) payments is a mechanism by which users can transfer funds from their bank account to another individual's account via a digital medium.

How much time is needed to create a money transfer app?

This is a tricky one. There are so many factors that affect the time spent on developing a money transfer app such as the platform being used, development tools and any customization.

If outsourcing the build to Intellectsoft, both you as the client and Intellectsoft will have a shared understanding of objectives and project completion dates.

Why do I need a money transfer app?

Old school payment methods are becoming outdated. Yes, cash makes the world go round, but a cashless society will soon be the main objective. There’s a huge demand for it, and most importantly, it provides much-needed financial inclusion.