A financial crisis in 2008 resulted in the rise of neobanks, financial institutions that have no physical branches and operate only online. The initial business idea of neobank was simple and clear — to cut the operational expenses for banking services in a time of crisis. It was just the beginning.

The boom of smartphones and mobile technologies supported the growth of neobanks, driving further demand for online banking services. The COVID-19 pandemic also became a power force for neobanking, being the safest available option: contactless payments decreased the spread of disease.

Now the global neobanking market is valued at 66.82 billion and analytics predict steady growth till 2030. Fintechs use the power of modern technologies to compete with traditional banks, and cloud computing solutions are at the top of this list. It seems cloud-based banking is the industry’s future. Let’s take a look at the success of neobanks and the cloud that backs it.

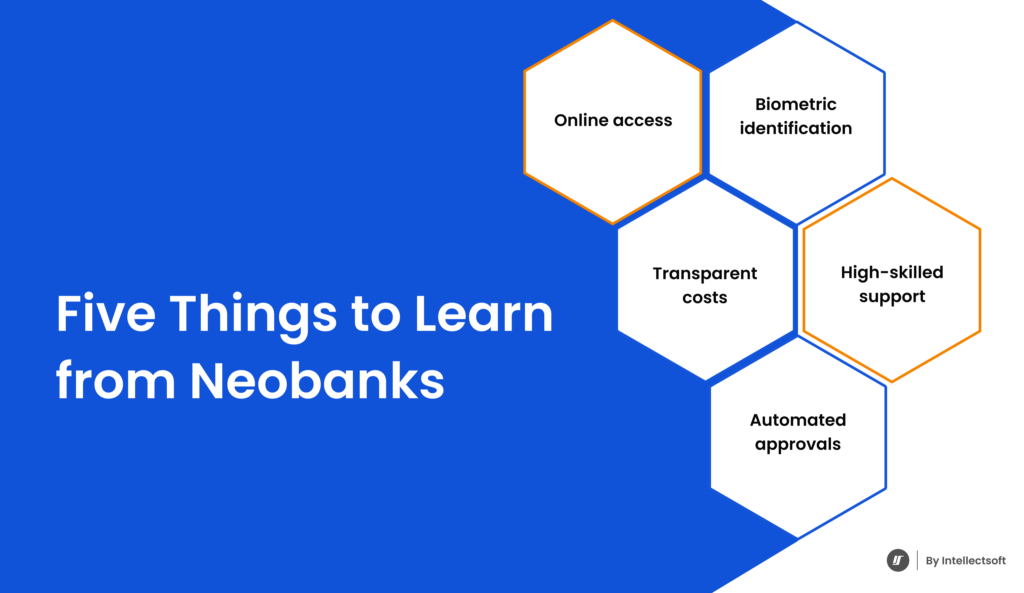

Five Things to Learn from Neobanks

Fintechs changed the way people save, spend and invest. Naturally, neobanks grabbed market share from traditional banks: in different regions, they make up 30 percent of the total banking market. So, traditional banks have been forced to learn from neobanks and adopt the best practices to stay competitive. Let us consider the main advantages of cloud banking.

Online Access

Neobanks do not have physical branches, they are accessible via web and mobile applications. Surprisingly, for most routine banking operations, this is enough. In-person visits to the bank branch seem like a waste of time.

Biometric Identification

Customers use biometric data — fingerprints, retina scanning, face ID — to access neobanking services. Mass demand for this technology made it available and secure. It is safer than traditional identification methods like PIN-code, signature and identification by photo.

Transparent Costs

With traditional banks, the cost of services can be high and unclear. With cloud-based banking, every fee is clear and transparent. Moreover, a client knows the cost beforehand and can reject a deal if he or she is not satisfied with the price.

High-skilled Support

While a neobank client cannot visit a physical branch to deal with a problem, all issues can be solved online. This means cloud banks have excellent online support teams, with a high level of technical and soft skills. Traditional banks can rarely claim the same.

Automated Approvals

With traditional banks, the approval processes for services and transactions take time because they are manual. With neobanks, the approvals are mostly automated and take seconds.

Traditional banks could probably develop and offer these advantages with time, but the situation in the world and the banking services market evolved very quickly and they just could not react with the same speed. So, neobanks appeared as an alternative to traditional banks and introduced the above-mentioned features. But there is even more.

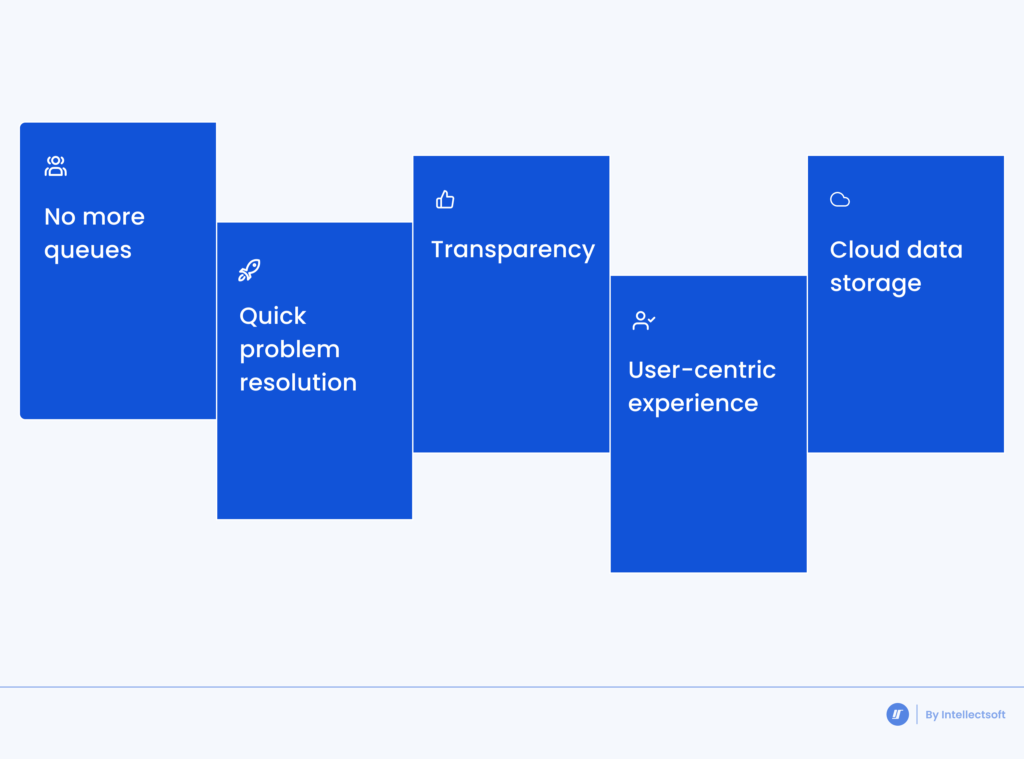

Five Benefits of Neobanks

Cloud-based banking has a lot to offer a new generation of customers. While older people mostly trust traditional banks more than innovative mobile solutions, youngsters appreciate the benefits of neobanking. People who stay online 24\7 require banking services at their fingertips. Simply speaking, online access to banking services comes with a host of other benefits.

No More Queues

Nobody likes queues at the bank especially when it’s for a small transaction like utility payments or card-to-card transfer. Neobanks proved that most routine operations can be conducted online, and there is no need to waste time in a line.

Quick Problem Resolution

It would be incorrect to say that the online support team solves all problems immediately. Sometimes it takes time for a problem to be resolved. Anyway, it cannot compare with offline service, including the time to visit a bank office.

Transparency

With neobanks, customers have immediate access to routine services, like account balance checks, transaction history, card-to-card payments, etc. It means better control and transparent money movement. For example, a client can immediately see an unauthorized transaction and call support.

User-centric Experience

While cloud banks are only available online, they pay much attention to their application to make it accessible, convenient and customizable. A client can get many custom functions, from interface color to automated regular payments.

Cloud Data Storage

Neobanks store their data in cloud storage, without relying on outdated legacy systems. It means faster operations, automated approvals and faster services in general.

Looking at the benefits of neobanks, it seems they are a perfect stage in the banking industry evolution and should push the traditional banks out of the market. However, nothing is perfect, and cloud banking has its challenges.

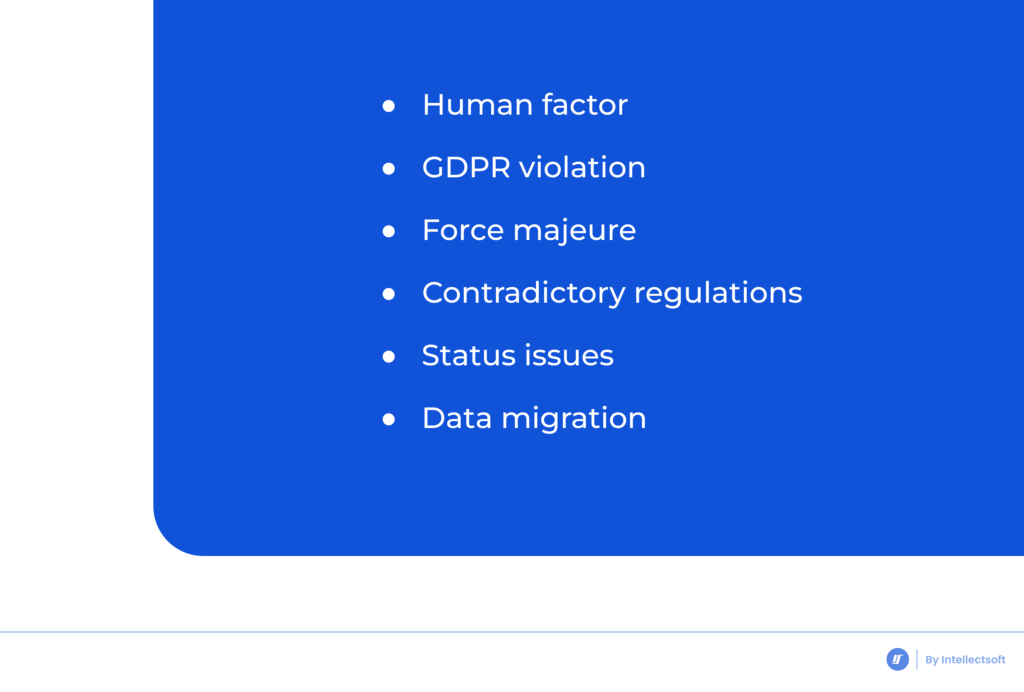

6 Challenges of Cloud-based Banking

The challenges of cloud-based banking solutions can kill the euphoria of their benefits. In particular, there are some major and minor risks both for banks and customers.

Human Factor

Modern technologies implement the best data protection solutions. However, people can still intrude on the processes. The impact of the human factor can appear at different levels, starting from a simple data entry mistake up to system failure. It is impossible to protect the cloud system from human incompetence 100 percent of the time. Traditional banks are less vulnerable to human mistakes because of slower processes.

GDPR Violation

All companies promise to keep clients’ data safe, but not all keep their word. For example, in 2020, Google faced a five billion dollar lawsuit for GDPR standards violation. We never know which company will break its own promises and start trading sensitive information. Of course, traditional banks can also do this, but neobanks seem more vulnerable to this because of all the data in the cloud.

Force Majeure

A bank does not control its infrastructure. Mostly, it is a benefit, but when the cloud service provider faces unforeseen circumstances, like a natural disaster, server downtime is possible. A bank cannot manage the situation and its customers can be without access to their banking until everything is fixed.

Contradictory Regulations

The banking industry is the most regulated in many countries. Failure to meet the regulations results in fines. At the same time, cloud solution providers also follow regulations, which sometimes contradict banking regulations. The simplest way to avoid fines is to hire a compliance expert to remove the conflicting rules and mitigate the risks.

Status Issues

As we mentioned above, neobanks are not banks but financial organizations. The main difference is the type of license. As a result, neobanks act like banks and provide a broad range of banking services, but they cannot operate without the support of traditional banks. This precarious situation causes many contradictions and requires changes in the global banking system.

Data Migration

When traditional banks start using cloud services, they always face the need to migrate the entire architecture into the cloud. According to Bloor Research, one in three migrations ends with failure. The problem lies in the absence of a high-skilled IT team that can handle the process. Finding a team of experts is a pain due to scarcity.

Need a team with expertise in financial solutions? Get in touch with us.

What Is a Hybrid Cloud?

There are three main types of cloud solutions, differentiated by level of privacy: public, private and hybrid cloud. Public clouds are familiar to most of us: Google Environment and Microsoft 365 count a billion users. A private cloud, also known as an on-premise server, is a popular enterprise solution. It can be assessed only by authorized staff.

However, modern businesses want to combine the secure on-premise server with the benefits of public clouds. This combination is called a hybrid cloud and for now, it is the most popular in the enterprise segment.

Hybrid Cloud Adoption in the Banking Sector

There is no question that banks and financial institutions should adopt hybrid cloud technologies. If they do not migrate to the cloud and modernize their infrastructure, they cannot follow their more innovative and responsive competitors.

According to Gartner, 70 percent of banking and investment respondents increased their cloud spending in 2022, and plan to do more until 2025. Most of them prefer a hybrid cloud solution that combines an on-premise server for sensitive information and public clouds like Amazon AWS for customer relationship management, marketing, data analysis, fraud detection and other functions.

Migrating to the cloud for banking means better efficiency in operational processes and greater flexibility in new business models, better customer services and products and the ability to focus on the core business without needing a series of machines to run it.

How to Start Implementing a Hybrid Cloud in the Banking Sector

The process of modernization and data migration to the cloud can take months. To avoid failure and banking service disruption, a bank should have a well-trained internal IT team or hire a professional service vendor.

A strategy stage is crucial for successful hybrid cloud implementation to ensure continuity of service without interruption or downtime. An IT team and bank representatives should discuss, develop and approve a comprehensive implementation strategy and consistent architecture. A migration strategy should include not only the specific needs of the banking business but also all related institutions. Only after strategy approval can the process of implementation start.

Hybrid Cloud Implementation: Main Challenges

Adapting traditional IT to new hybrid infrastructure is a key issue for banks due to the large volume of legacy technology and compliance requirements.

- Many banks have existed for decades and even centuries, so they have long track records. It means that they have significant legacy technology that needs to be adapted for use in a new hybrid ecosystem.

- Banks need to make sure that any data stored in the cloud is secure and compliant with applicable laws and regulations. To do this, they must ensure that their hybrid cloud environment has strong security measures.

- Banks also need to keep an eye on third-party vendors and make sure that they are not using any outdated or insecure technologies or services.

- Additionally, they need to choose a technology partner that has experience with banking solutions and understands their specific needs so implementation projects can go smoothly.

When it comes to selecting the right platform for their hybrid cloud solution, banks must consider a variety of factors such as storage capacity, scalability requirements, cost-effectiveness, customer experience delivery timescales, etc., before making a decision.

Where to Get Hybrid Cloud Services

Major banks can afford to keep the internal IT department to develop and implement both private and public clouds for the bank, integrate it, set up all the necessary applications, check compliance, and perform other steps.

However, the internal team has its own weaknesses. Having broad expertise in local infrastructure, networking, hardware and software, they usually lack experience in the cloud for the banking industry. The alternative is to find an independent banking software development company.

Intellectsoft offers to advance your efficiency, customer experience and business performance using the power of Intellectsoft software development for banking and financial services.

If you want to learn more about how your bank can use cloud technology as the catalyst for enterprise transformation, don’t hesitate to contact us. Our managers will reach out to you in order to provide you with the most detailed information and help you make your first step to a more digitized business.

FAQ

What is Cloud-based Banking?

Cloud-based banking is a combination of hardware, software and services that allow banks to focus on their core activities while delegating the care for IT infrastructure, technology, networking, hardware and software to a cloud service provider.

Can Cloud Banking Completely Replace Traditional Banking?

For now, cloud banks do not have full banking licenses. They need supporting traditional banks to work with some banking products. It would be more reasonable to predict that traditional banks will migrate their core banking to the cloud.

Why Use a Hybrid Cloud for Banking?

Hybrid cloud technology for banking allows for combining a private cloud for sensitive and vulnerable data with a public cloud for some business aspects, including marketing, analytics, and service personalization.

Cloud Banking vs. Traditional Banking: What is Better?

Cloud banks are more user-friendly and flexible. Moreover, they can offer higher rates. However, they cannot offer some products and require the backing of a traditional bank. Also, traditional banks usually have better coverage and more users.