Like many other areas, the insurance industry implies using powerful software for successful business managing. Various systems are applied to enhance the connection between the insurance agency and the loyal customers or potential clients. Additionally, the process’s automation significantly improves the workflows and data-processing, thus boosting the company KPI.

This article will look deeper into the insurance agency accounting software, which plays a crucial role in the agency’s brilliant management. Furthermore, you will find out all the benefits & examples of the accounting software for insurance agencies.

What Is Insurance Accounting Software?

The insurance accounting software is the automated transaction recording system and managing, which is focused on the insurance industry’s needs, targets, and requirements. It is used by the insurance agents, who introduce and sell the insurance company’s products to the clients for a commission.

The insurance agents represent the company in the transaction. So, the insurance accounting tools are a must for the processes of calculating and recording.

Also, this specific accounting software for insurance agencies have the following tasks:

- simplify the audit processes

- automate the risk analysis on return for a premium

- optimize the transaction accounting & operating

- analyze the liabilities, revenues, expenses of the agency

Thus, insurance accounting implies combining the accounting bases with a better understanding of the insurance processes.

Furthermore, the software type can vary depending on the insurance unit’s types: the agency representatives and the insurance brokers’ needs are quite different. So, the software peculiarities will be various as well.

Examples of Accounting Software for Insurance Agencies

According to the Capterra.com rating, there are over 130 products of the insurance agency software. Let’s learn more about the most popular of them.

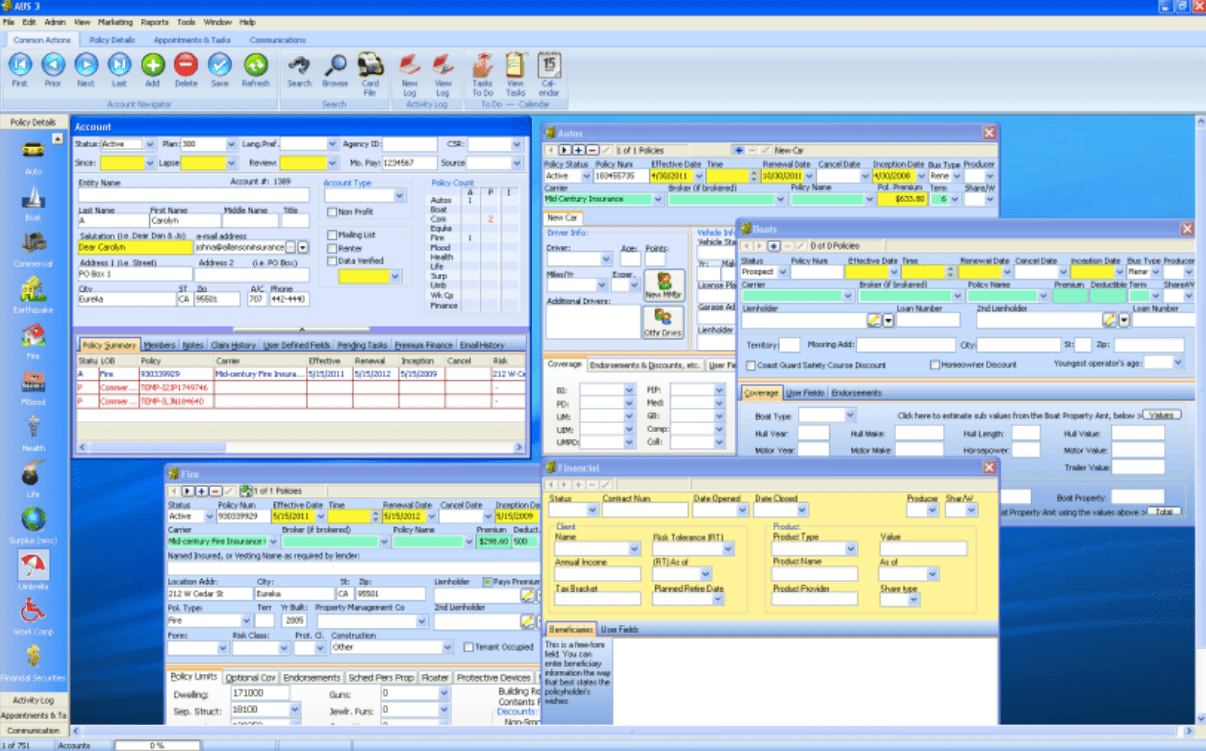

ABS by Agency Business Systems

Thanks to its simplicity, this software allows to automate the data process operations, create various tasks & reminders, calculate the custom reports, and more. Besides, ABS was also recognized as the “Best Ease of Use Insurance Agency Software” in 2020.

Source: ABS® main screen showing account information and several policy screens all at the same time.

SIBRO

The basic features you can get with that insurance agency accounting software includes commission management, document & contact management, and the payments operating and recording.

Additionally, this SaaS system is compatible with tablets, mobile, iPad, desktops, etc.

C2MS

Designed for insurance organizations, that tool can greatly simplify business management and improve its efficiency. The major feature of the C2MS system is that it can be deployed both On-Premise or within the Cloud.

Accounting Insurance Software for Insurance Brokers: What’s Different?

According to Forbes, 15% of millennials, 16% percent of Gen Xers, and 8.5% of baby boomers are planning to buy the insurance in 2020.

The insurance industry’s huge perspectives lead to more and more brokers offering their service in this area. However, their responsibilities are radically different from insurance agents.

Unlike insurance agents, insurance brokers represent consumers in finding the best insurance option for their preferences and needs. Mostly, brokers research various insurance company’s terms & conditions, rating, and cost to offer the best choice for the insurer. They can also warn of insurance traps, pitfalls, and legal requirements, which is another advantage for the clients as well.

Examples of Insurance Broker Accounting Software

So, because their responsibilities and needs are different, the insurance broker accounting software will also be different. Now let’s have a look at the accounting software for insurance brokers, which can greatly boost workflow efficiency.

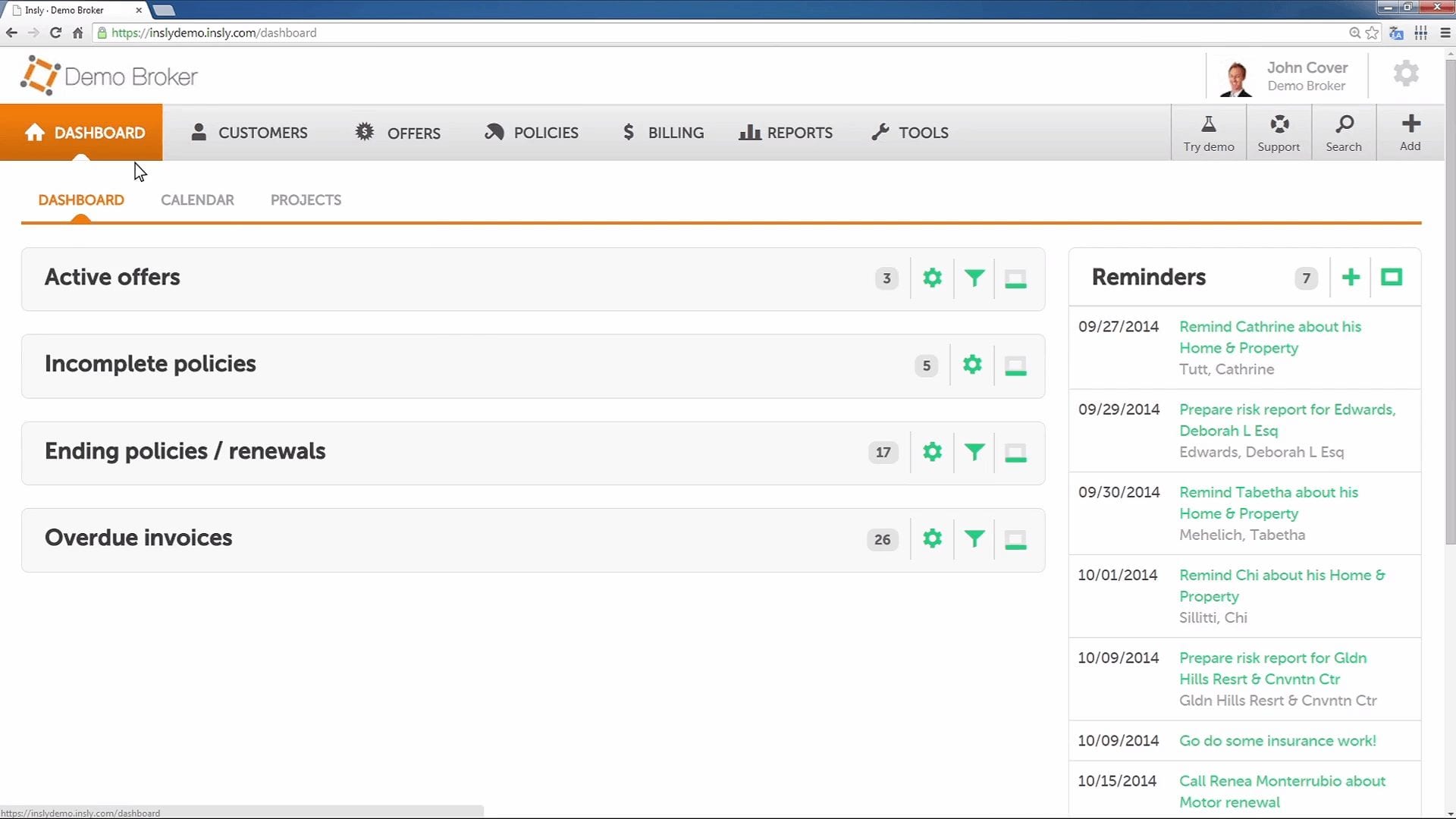

Insly

Designed for the brokers & agents’ basic needs, Insly is a perfect option of accounting insurance software. It implies various process automation for the brokers’ business services, such as commission and fee revenue accounting.

A1 Tracker

A web-based insurance software helps manage the data, record the transactions, and generate batch invoices and reports for the clients. Also, it is quite flexible and customizable accounting software for insurance brokers.

Source: Software Connect

The Key Benefits of Accounting Software for Insurance

As you can see, accounting software can greatly improve the process of automation in the insurance industry. And, there are many more advantages of the accounting insurance software we haven’t mentioned yet. So, let’s learn it in short.

Profit of Accounting Software for Insurance Brokers & Agents

Of course, the service type of the insurance agents and insurance brokers is different. Nevertheless, they can still get the common benefits of applying accounting software for insurance:

- accounting processes automation

- losses preventing and risks analysis

- service efficiency improving

- taxes managing

- income & costs monitoring

All these advantages improve the workflow and enhance service quality, thus widening the target audience and meeting the major clients’ needs.

Insurance Agency Accounting Software – Quick Summary

The insurance agency accounting software is now a must for successful process automation and managing.

In this article, we’ve discussed the insurance agency accounting software benefits, challenges, examples, and where to find custom insurance software development services.

At Intellectsoft, we develop custom solutions to help insurance companies reach their goals. Are you and your organization looking for improvements? Talk to our experts and find out more about the topic and how your business can start benefiting from it today!