In the financial sector, digital transformation is scaling. These days, the wide application of artificial intelligence (AI) technology is remarkable, leading to the appearance of entire AI banks.

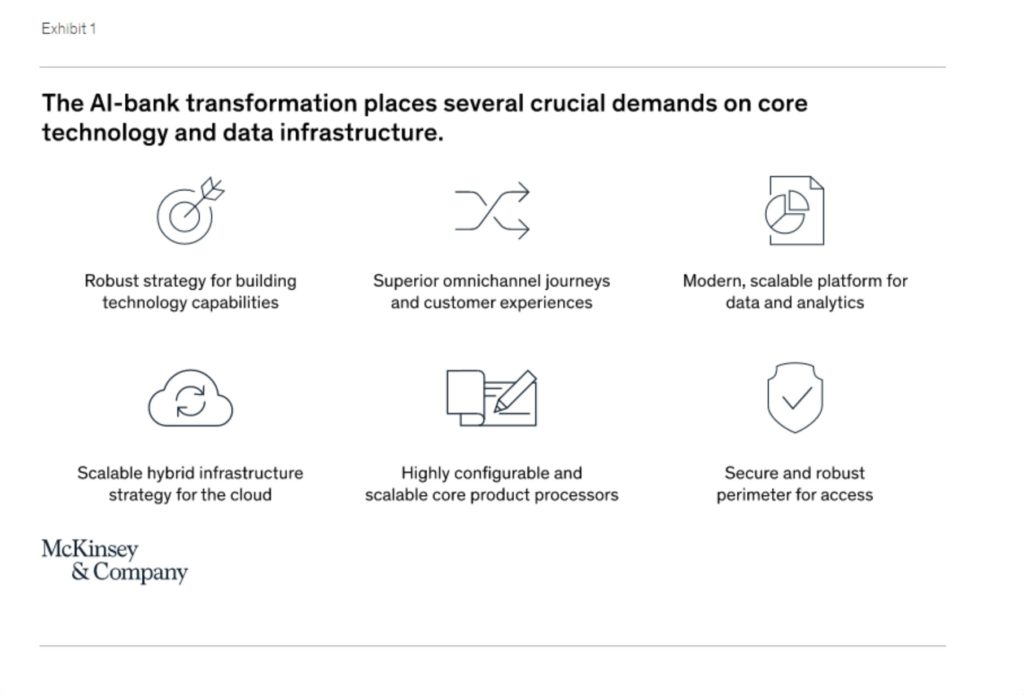

These brand-new institutions successfully deal with several key demands for the industry players, including having a robust strategy for building the computing infrastructure, establishing omnichannel experiences for clients, having a modern and scalable platform for data and analytics, and being cloud-based, configurable, and secure.

Thanks to these capabilities, AI banks are going to shape the digital transformation for the banking sector in the near future.

In the given circumstances, loan management systems are essential for building an effective financial business. Being specified on making loans faster, more accurately, and easier, this technology addresses the current demand for a leading-edge operational model that enables smart servicing and experience.

In this overview, we’ll explain how the systems for loan management work and what they are good for.

What Is LMS (Loan Management System)?

The software is a digital banking enhancement that facilitates the loan lifecycle as a whole. In particular, the technology is capable of:

- assisting in processing client data

- creating new loans

- generating accurate statements and reports for lenders

- managing interest rates

- serving collection automation.

In addition to these features, an important capability of loan management solutions is scalability. They not only facilitate processing for separate tasks but also automate the entire process.

Loan management software is an end-to-end service that covers key processes in cash and liquidity management, lending for commercial, consumer, mortgage, and syndicated needs, loan origination, and collateral management.

This way, the solution opens the door for new business opportunities as you can create a more comprehensive corporate environment and deepen the relationships with customers.

How Loan Systems Improves The Lending Experience

Having a seamless digital solution for loan management facilitates all your business processes and establishes a great borrower experience for your clients.

Loan management digitalization helps to get rid of manual work and papers. Thanks to the toolkit incorporated, you can transform the way your institution operates. With Big Data and analytics, businesses get the effective instrument to automate loans and establish a machine-ruled procedure for account opening.

Combined with machine learning capabilities, these technologies can leverage even large investments, including student loans and trading. Altogether, these enhancements enable identifying new growth opportunities, managing back-office data more effectively, and structuring the existing loans from present software and papers.

Improving customer experience is critical for business success. With loan management solutions, it’s possible to introduce a customer-centric service and address the growing demand for self-servicing portals.

The system can speed up customer onboarding through automated tools and digital document management and provides your managers with the necessary client data to increase the accuracy of offerings.

4 Key Benefits of a Loan Management System

Investing in a loan management solution brings substantial advantages for businesses of any size. Startups can rely on this technology for dealing with the existing loans faster and more accurately, which is the necessary prerequisite for future growth.

Mid-sized companies can invest in the system for improving the customer experience, which significantly improves the retention rate and assists in scaling. For large enterprises, the key benefits include increased security and streamlining the workflow.

Notwithstanding the company size, loan management systems will improve the organization in 4 key dimensions:

- Customer satisfaction

- Corporate processes

- Risk management

- Opportunity for innovation

Let’s review the perks of each of these enhancements.

#1 Boosting Customer Satisfaction

Contemporary consumers have become digital-savvy, and each business should address their new demands to the maximum today. With the tool that collects all the key information about clients and possesses the capabilities to establish a self-serving portal, your abilities to satisfy your customers increase.

It’s important to address the need accurately, though. The easier your digital solution, the greater your chances of maintaining existing clients and attracting new ones.

In this context, loan management software stores all the relevant information about your clients and makes it possible to draw insights from the data. As a result, your employees will offer the most accurate services to customers, based on their preferences and loan history that the technology has carefully collected and accurately processed.

#2 Optimizing Corporate Processes

These days, many companies suffer from miscommunication, lack of structure, and duplicated tasks. Organizations dealing with loan management are not an exception to this rule. But with the software specially designed for managing loans, your enterprise gets the chance to get rid of these problems.

The unified platform will organize all the existing loan-related processes. This way, your workers can easily access the most accurate information about all the loans and collaborate on the data in real-time.

#3 Mitigating Risks and Errors

Financial services suffer from human errors, and the cost of the mistake can become catastrophic. That’s why automating the processes is a must-have step for the industry.

When it comes to the loan management system, the software deals with billing inaccuracies and payment tracking as the most common areas for making mistakes. By taking over these routine tasks, the technology lets your workers concentrate on working on data rather than dealing with the tedious work of filling spreadsheets and inputting the client information.

Even more, the communication platform in-built in the software lets your workers react on the recently updated information only, which significantly reduces the frequency of miscommunication in your office.

#4 Fueling Innovation

Even though the loan management system mainly deals with optimizing the existing processes, this solution also helps businesses innovate.

By being a cloud-based digital end-to-end solution, this software addresses the growing demand for connected banking and takes over the entire loan lifecycle, freeing your people’s time to conduct more strategic and creative tasks.

In particular, the solution provides and organizes all the relevant loan-related information, and your workers have the key data prepared. They can concentrate on detecting patterns, justifying the logic, and finding new opportunities and more accurate services for clients.

Most Common Loan Types that Can Be Managed with Loan Management Systems

- Personal loans, or loans for non-commercial use. In this loan category, the software will categorize secured and unsecured loans and store the credit history previously checked for easy access.

- Student loans, or costs to cover educational needs. The system will select the date, amount, and interest rate (if relevant).

- Commercial loans for businesses. Here, the software will assist in document management and automatically process the required data from these papers.

- Syndicated loans for multiple lenders. With the software for loan management, the middleman in the transaction can process this loan type faster and easier.

- Mortgage loans for real estate purchases. The system will take care of deadlines in this long-term loan and manage the needed documents,

- Short-term and high-interest payday loans. With the loan management system, your workers won’t lose this loan and won’t miss its deadline.

7 Essential Features of Loan Management Software

Once you invest in a custom loan management solution, check your tech provider can include these critical features in it:

- Loan origination. The machine should be able to check the risks and assist in the decision-making process when processing a loan application.

- Loan servicing. This feature of a loan management system deals with the complexity of loans, classifying them by interest rates, payment deadlines, and other critical criteria.

- Funds collection. The service should have a digital wallet module to enable payments. The data privacy for this feature is essential, and each online solution builder should invest in a secure payment getaway.

- Debt management. The in-app notifications should assist in controlling the schedule, fulfillment, and fee calculations for repayments.

- Communication platform. The system should store all the information in the same place and update it in real-time so that your employees have accurate and fresh data to act upon.

- In-app analytics. The loan system should process the data algorithmically to establish connections between separate data points.

- Reporting module. Data visualization is critical to control the business performance and keep track of cash flow.

Ask Intellectsoft for Help in Building the Software for Loan Management

If you’re looking for a loan management system that possesses all the above-mentioned benefits and features and blends well with your existing processes, you can refer to Intellectsoft.

With decades of expertise in the IT market, we can build a custom solution with all the necessary features for your business benefit. Among our financial software development capabilities, you can request as main or extra features these services:

- Online Banking with the solutions including custom platforms, mobile apps, security, UI/UX, and system integration.

- Blockchain and Cryptocurrencies with an ICO launch support, transaction operations, smart contracts, and identity management.

- Digital Wallet, or an app that enables P2P payments, digital money transfers, and in-app currency creation.

- AI and ML technologies for predictive and recommendation systems, natural language processing, computer vision, and data mining and analytics.

- Trading and Securities services that include securities trading, digital brokerage, blockchain ledgers, and AI automation.

- RPA, or Robotic Process Automation for account reconciliation, automated mailers, monthly account reviews, and regular reporting.

Talk to our experts and request a custom financial software development solution that will fully meet your business needs! Transform your business today with Intellectsoft as your reliable technology partner!