Legacy systems no longer serve their purpose of supporting the market’s rising needs and expectations. According to McKinsey, a comprehensive approach to modernizing the legacy banking system can reduce the time and money spent on achieving the same results by 70%. When such banks modernize such systems, they replace older, less efficient systems with new technology that’s designed to meet the business needs of the present and future.

Older technologies may seem hard to modernize, but if you want to remain competitive, it’s something you have to do. The good news is that with the right tools and a modern approach, you can successfully modernize your banking legacy systems without breaking anything else in the process. Here are some helpful tips on how to accomplish this feat.

What is a Legacy System in Banking?

In IT, a legacy system is an older computer system or application program that continues operating long after newer systems have been introduced. Newer systems are sometimes described as greenfield or brownfield systems, depending on whether they replace a working system or upgrade an older one.

The term legacy comes from legacy code — the term for obsolete programs that continue operating as-is. As a rule of thumb, legacy code is 10 years old or more; most often it refers to internal accounting applications.

In the banking sector, legacy systems include many of today’s most popular banking apps, from online banking portals to mobile and desktop Internet-banking apps.

Many of these systems have become unsustainable due to increasing demand for new features and improved user experiences, making it difficult for financial institutions (FIs) to service customers with ease and efficiency. That’s why it’s business-critical to modernize banking legacy systems.

Why Do Legacy Systems in Banking Need Modernization?

Customer demands. Among all, legacy banking systems make it hard to provide high-quality service to your clients. Mobile payments, instant interactions, secure data storage and personalized banking are just a few examples of what today’s consumers demand from their banks. Frequently, legacy software simply cannot keep up with these demands.

Maintenance cost. Supporting legacy systems in their current state is time-consuming and costly. Frequently, companies turn to expert help for that. However, several updates can go a long way toward improving performance — even increasing speed and stability — without incurring an enormous cost. Modern technologies can even automate your strategic decisions without the need to maintain the separate department of data scientists to manage them.

Need for innovation.To remain competitive, sooner or later, each bank faces the need to update their legacy software. A modernized banking system can improve security and customer satisfaction while also reducing operating costs and risk exposure, which means solving numerous internal problems and serving customers better.

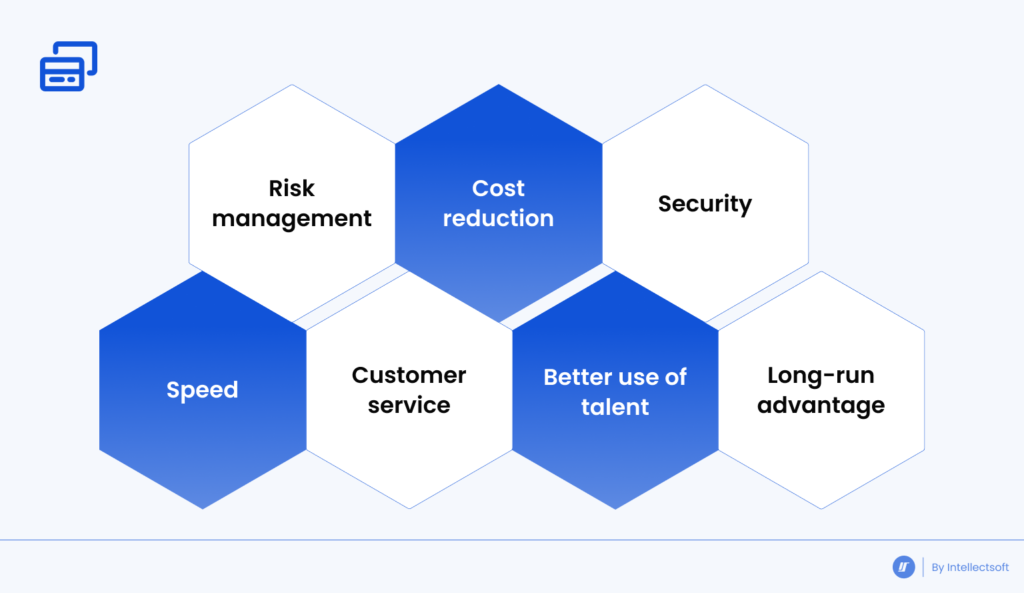

Main Benefits of Modernizing Banking Legacy Systems

- Risk management. The newer technologies reduce the risk of regulatory compliance through internal control.

- Money. Modernization can drive down operating and delivery costs and improve efficiency of staff through technology.

- Security. Cloud technologies introduce scalability and flexibility while maintaining the safety of your strategic assets.

- Speed. With modernized legacy systems in banking, you can get access to digital capabilities that accelerate the pace of innovation in your organization;

- Customer service. The improved areas include service levels and customer satisfaction.

- Better use of talent. Instead of wasting your employees’ time on supporting older systems, you save their time on more strategic tasks through modernization.

- Long-run advantage. Although investing in modernization needs extra money, their maintenance and operation will be cheaper in the long run.

Best Practices and Tips for Legacy Software Modernization

When it comes time for a financial institution to consider updating a legacy system, many questions arise: How will we finance modernization? What is our exit strategy from our existing environment? Is our data at risk during implementation? When should we start planning for a project like modernization?

Here is a collection of working approaches to answering these questions about modernizing legacy systems in banking.

Take Time on Preparation

First, understand how automation fits into your overall operations. While automating individual processes might seem like a good idea, it may not integrate well with other parts of your business. Thus, make sure you set clear goals for every automation project and create an implementation strategy that will work for you and last over time.

To prepare for modernization, you need a plan that ensures process efficiency and takes advantage of current technology. You also need a realistic budget. If your bank is currently using an old application that’s missing features and needs updating or repairing, you don’t want that updated version causing more problems than it solves. It should be a strategic part of your business’s growth plan.

To get started, gather ideas on how customers interact with your bank — both in person and online — and jot down new processes you could introduce. For example, if customers are always waiting in line at one branch location on Thursdays after lunch, maybe they would appreciate a mobile app so they can do their banking from anywhere, anytime. After collecting all these ideas, you can start searching for a reliable tech provider who can help you with the needed modernization.

Pick Your Tech Partner Wisely

While modernizing legacy systems in banking, it's important to find a reliable tech vendor who can implement your ideas into reality. Be prepared for lots of questions about your system, and make sure you ask lots of questions, too—it's critical to understand just how complex and difficult your project will be in advance.

Also, check the portfolio and technical capabilities of your future partner. It’s best to research ahead of time what kind of projects they've worked on in their past. The more relevant experience they have, the better off you'll be..

Deloitte experts also recommend focusing on business impact and total cost of ownership, not just technology features and purchase price. While talking to an IT company, remember that the best way to ensure that your legacy modernization efforts are successful is by focusing on business value — not just because it's easier to measure, but also because it forces you to ask tougher questions. Take an active role in decision-making so that you end up prioritizing your project wisely and aligning it to your financial goals.

Guiding Principles to Updating Legacy Systems in Banking

While working on the project, stick to these 6 key principles from the McKinsey list that contribute to successful modernization of legacy systems in banks:

- Establish a flexible data platform. Don’t try to bring everything into a single new data platform: you will get bogged down in complexity and leave out key sources of high-quality data. Instead, start with those golden sources that provide deep insight into customer behavior or performance, such as credit card transactions or mobile phone records, and work on creating intuitive interfaces for these operations.

- Use microservices: Focus new development on decentralization, changing behavior, and building new applications that are tailored to how today’s customers want to interact with their banks. Microservices are a good fit for this aim.

- Categorize capabilities for customer journeys: Banks should identify key customer processes and map out their specific requirements for seamless digital experiences. The first step is identifying which functions are essential at each stage of a journey — and which are not. It may be tempting to use new technology as an opportunity to provide every possible service; but banking leaders should be aware that they could create distracting complexity if they don’t maintain simplicity at every step.

- Prioritize integration: Rather than simplifying systems, leading banks use a strategy of integrating with modern tools while keeping legacy core intact. Then, they start slowly moving core processes to their new environment over time.

- Rely on SaaS for non-critical capabilities: While many enterprises still rely on internal resources for service delivery, SaaS has proven especially effective for streamlining business processes. By moving applications like HR, procurement and other back-office systems (such as accounting) from onsite servers to a cloud platform, IT teams can focus their efforts on upgrading their mission-critical software.

- Think globally, act locally: Global platforms are good but have their limits. If a bank takes an overly broad approach, it may build barriers for future innovation and harm customer outcomes by forcing them onto one global platform. Instead, focus on creating shared data models and core services that can be extended to support business-critical activities while remaining agile enough to accommodate alternative paths.

How Hard is It to Modernize My Legacy Banking System?

Initially, the idea of modernizing legacy systems was too unrealistic for many banks. The only option available was total replacement, which required tremendous effort and heavy investments.

But things have changed these days. Intellectsoft has already delivered several examples of legacy systems in banking that didn’t require heavy changes but modernized the outdated parts. We use the recent technology advances and approaches from our set of financial software development services:

- Online banking. We create new experiences for customers through custom online banking platforms, mobile apps, security technologies, UI/UX, and system integration.

- Digital wallet. We enable P2P payments, facilitate digital transfers, and introduce in-app currency with enhanced security and tailored promotions.

- Trading and securities. Services for mobile stock tracking include digital brokerage, blockchain ledgers, and applying AI and automation.

- AI and ML. We have vast experience of working with Fintech trends for mobile app development and can introduce predictive and recommendation systems, Natural Language Processing, computer vision, and data mining and analytics into your bank.

- Robotic Process Automation (RPA). The technology improves productivity and provides intelligent automation through account reconciliation, automated mailers, monthly account reviews, and regulatory reporting.

- Blockchain. We apply the technology behind cryptocurrencies to increase security, cut transaction fee costs, and introduce automation. Our services in this area include smart contracts, identity management, ICO launch support, and cryptocurrency operations.

Ready to start the modernization? Talk to our experts to discuss the best approach to updating your legacy systems and start improving your banking today!